By Christine Gibbs

To move or not to move…that is the question. And these days, it’s an all-too-familiar one. This is particularly true at the extreme ends of the demographic spectrum in New Jersey, with downsizing Boomers and upwardly mobile Millennials looking—and, in some cases, competing—for apartments in or near their hometowns. This has led to an explosion in rental property development in walkable downtowns as well as traditional suburbs, and it is changing the landscape of how and where people live in the Garden State.

www.istockphoto.com

For aging Baby Boomers, apartment living has become a viable alternative to the three “traditional choices”: heading south, joining a retirement community or staying put and dealing with the consequences, whatever they may be. That’s because they are living longer and living better—however, it’s time to move on from a home with the physical and emotional burdens of high carrying costs and endless maintenance. Seniors, retirees and pre-retirees are coming to the mass realization that where they live now is not necessarily where they should live tomorrow.

Meanwhile, for young professionals in their 20s, the appeal of home ownership has lost much of its luster. Home prices and taxes in New Jersey are high and the job market—while growing—is unpredictable. For some, the mobility and convenience of renting a stylish apartment with contemporary amenities is more important than owning something that could conceivably tie them down. For others, the lack of disposable cash or minimal borrowing power makes renting the only option.

What these “bookend” groups have in common is that, when it comes to apartment living, they are more sophisticated, more determined, and more selective than ever. What do these kids want? They want out of their parents’ basements. The Failure to Launch stereotype is the exception, not the rule, in New Jersey. For most Millennials, personal finances are the driving factor regarding their next move. Modest entry-level salaries, student loan debt and a tight starter home inventory limit their choices and often that first apartment is a dog. Yet, all is not doom and gloom. The job market is strong in Central New Jersey, particularly in the tech sector, where wages can support rents of $3,000/month or more. And that can get you something very nice in a place you want to live—maybe even close to friends and family.

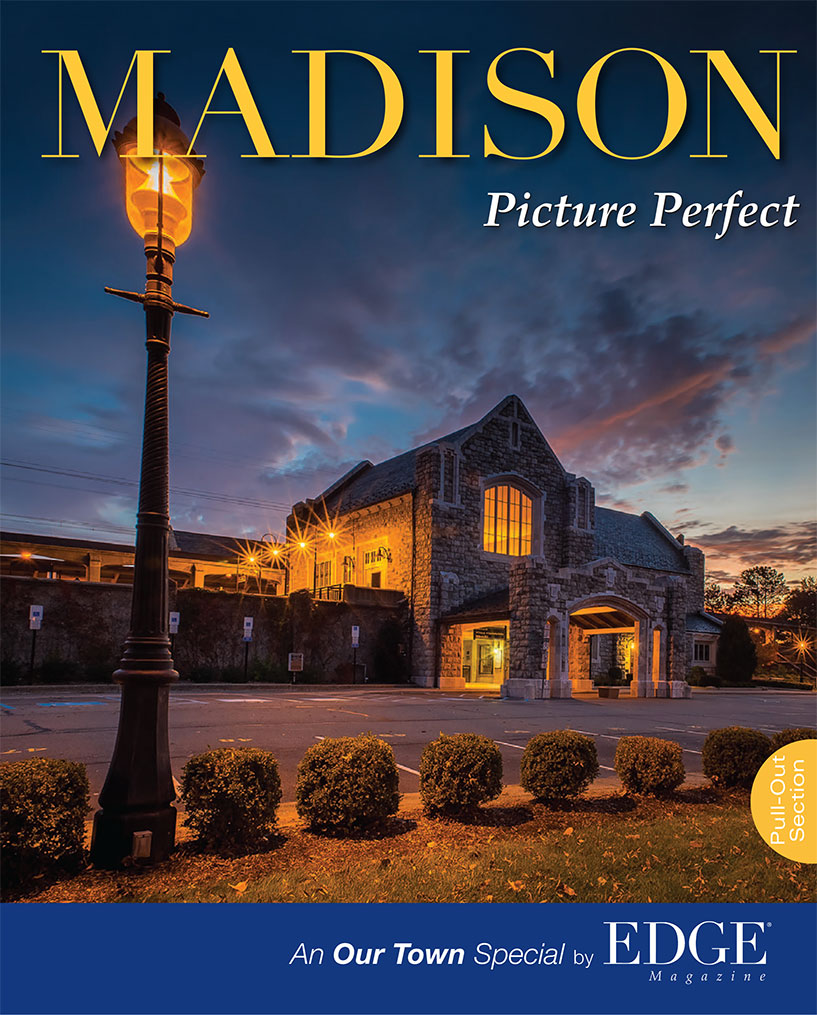

That being said, price and convenience are not enough to close the deal for this new generation of young apartment hunters. Millennials with healthy incomes are steeped in the belief that if they just keep looking, something perfect will come their way. They will visit dozens of apartments until they find someplace that suits the exact lifestyle they envision for themselves. They want a move-in ready unit in a hassle-free environment. In the suburbs, they typically want to be steps away from public transportation (“transit villages”) with nearby cultural and educational resources, walkable or bikeable to a dynamic town center complete with a wide variety of retail and restaurant choices. Young apartment dwellers also want to become part of a community that offers a more upbeat, healthy and relaxed atmosphere. All of this, not surprisingly, commands a higher-than-average rent…and creates an opportunity for developers who understand the vision of Millennial renters.

www.istockphoto.com

This is not your father’s suburban apartment

And yet, it’s your father who may soon be moving in. One of the charming ironies of the new wave of luxury apartments in the New Jersey suburbs is that they are equally appealing to Baby Boomers who are aging out of their longtime (and often nearby) homes. For builders, this is a gift. They have two completely different demographic groups vying for what are essentially the same units in the same developments. The 50-, 60- and 70-something renters have little in common with Millennials, other than a certain kind of pragmatism. As a group, they are adjusting, not always gracefully, to the idea of senior citizenship.

With that adjustment comes the realization that their personal finances and/or health and mobility no longer support traditional homeownership. Even a generous retirement income is still a fixed income, which means budget-busting maintenance and repair projects can be earthshaking. And the physical demands of living in a multi-story house or a large property can become overwhelming at a certain age. So it is that Boomers at or near the age of retirement often find downsizing an unavoidable if not irresistible next step. Actually, the politically correct expression is now “rightsizing.”

What does right sizing look like? For most people with “too much house,” the decision is whether to move to a smaller house or to venture into the relatively unfamiliar territory of the rental market. Abandoning the family home only to replace it with a lesser version might just be moving into someone else’s headaches. Renting, on the other hand, holds the promise of less hassle and more freedom: No more calling in a repairman every time there’s a problem—instead just pick up the phone or maybe text the “super.” No more aching joints, just leave the heavy yard work to the groundskeeper. No more worrying about safety, simply enjoy the peace of mind that secure communities provide.

Checking all the boxes

What do seniors want? Older renters often choose to remain close to the old neighborhood as a comfort zone to avoid disrupting established routines—a town or two away is fine. They want to keep seeing the same doctors, shopping at the same stores, and staying close to old friends. Popular senior-specific demands include ground floor/single-story units, regular trash removal and recycling, access to a pool or some other water feature, and a resident population that includes a reasonable cross-section of age groups.

www.istockphoto.com

Millennials have loftier goals for their dream apartment. They want to expand their personal horizons. They are not as concerned with details such as square footage and storage areas (since most of them are not dragging a lifetime of possessions with them). As a group, young renters are looking for a “live–work–play” environment so that space for an office/den and top-of-the-line technology takes precedence over more practical considerations.

Bookend renters do have much in common. Both groups are seeking an active, healthy, and stimulating community. Everyone looks forward to abandoning dependency on personal vehicles; they prefer the more green alternative of walking or biking to nearby stores and cultural and entertainment destinations. They might not be able to afford something fancy in Hoboken or Jersey City, but a well-designed apartment near a charming, revitalized town center or traditional Main Street tends to generate a lot of interest. Seniors want to enjoy the quality of life they have worked so hard to earn. Millennials want to create the living space they have always wanted. No one in either group objects to high-end amenities such as heated or lap pools, upscale bistros and specialty restaurants, comfy coffee bars, appropriately equipped gyms, movie and performance spaces, and community activities of all kinds. Something else they can agree on is 24/7 concierge-like services and high-tech security arrangements.

www.istockphoto.com

Wooing the bookend market

Recognizing the differences between these growing groups of high-end renters—while also seeing where their interests dovetail—can lead to some interesting (and, more importantly) profitable solutions from on-trend developers. The goal is to find common ground, literally and figuratively, in terms of location and also amenities, lifestyle preferences, and pricing implications. Despite the rising cost of construction, taxes, and land in the Metropolitan area, developers remain bullish on the New Jersey market. High-end, multi-use complexes are springing up everywhere. And with renewed interest in “downtown” living, the profit potential in rental ventures has never been more attractive.

Photo courtesy of AVE

Examples of some high-end, multi-family, and multi-use communities are the phased Harborside developments on the Jersey City waterfront (Mack-Kali), the new and renovated projects such as Pier Village on the Gold Coast of the Jersey Shore (Kushner Companies), and the West Side Lofts at Red Bank (Woodmont Properties), an upscale and upbeat apartment complex that has helped to transform a rag-tag neighborhood into a live-shop-eat-work-commute mecca for a broad swath of the bookend demographic. The most ambitious multi-use project on the drawing board is Riverton (North American Properties), which will stretch for more than a mile along the Raritan River in Sayreville. No formal date has been set for its completion.

Another successful developer on the high-end spectrum is AVE, a division of Korman Communities, a fourth-generation, family-owned company with a 100-year history in the real estate business. Korman was a pioneer of the hospitality approach to corporate housing starting back in the ’60s. AVE communities offer a flexible inventory of annual and month-to-month lease arrangements for completely customizable one- and two-bedroom units. The goal is to make residents feel at home, whether a short-term business professional or a right-sizing senior. As an owner/operator, it’s possible to customize even the smallest detail for AVE tenants. Lea Anne Welsh, President of AVE and COO of Korman Communities, attributes the company’s success to “a unique entrepreneurial spirit and an open-mindedness to be flexible and innovative.” The corporate mantra is Yes, we can!, says Welsh, “and then making it happen.”

The company is bullish on the New Jersey real estate market, with future plans that include expanding in the Route 78 corridor, the Princeton area, and the Jersey Shore Gold Coast.

“Korman is in the business to wow people,” adds Welsh.

While no one moves into an apartment believing it will be their last, those eyeing an upscale solution or interested in engaging a multi-use community are definitely thinking long-term. Will this work for me a year from now? Five years from now? Ten years from now? A lot of research goes into this decision, whether you are an old-timer or a first-timer. What is a “bell and whistle” and what is a truly valuable amenity? Will this apartment (or this development) suit my needs as I ease into retirement? Can I raise a family here? In what ways is this neighborhood changing and growing?

The biggest question of all, of course, is Am I ready to make the move? Once you’ve cleared that hurdle, the choices are nothing short of sensational and they are only getting better. Moving in and moving up has never been easier. Or more synonymous.

Photo courtesy of AVE

Community Spirit

Earl Wilson, who bought a home in Summit in 2000, decided it was the right time to downsize last summer and determined that renting was the right choice for a single man of a certain age. “I can’t rave enough about my decision to move here,” he says of AVE Florham Park. Wilson guesses that the number of residents under 40 and over 50 are roughly the same. What he appreciates most is the warmth and sincerity of his new neighbors: “I know everybody in my building and they know me. There are plenty of group activities, but privacy is also always respected.”

One of Wilson’s neighbors is Ashli Dyas, who moved north from Atlanta, where she left a 6,000 sq. ft. home. She and her husband, David, came to New Jersey on a corporate transfer, and decided to extend the five-month lease on their 1,400 sq ft. apartment to a year. “We just knew this is where we were meant to be,” Dyas says. “Especially since renting here would mean David would not have to face shoveling any New Jersey snow.” She quickly joined a cohort of neighbors, ranging in age from 35 to 75, who have become good friends and great company. “I feel like I’m on vacation all the time. What could be better?”

Rent by Numbers

- New Jersey is the fifth most expensive rental market in the country.

- Median gross monthly rent in NJ is $1,284 vs. US $1,012.

- Rental Vacancy Rate in NJ is 4.45% vs US 6.18%.

- Two-thirds of all Americans live where it is more affordable to rent than buy.

- 40% of current renters cannot afford the down payment to buy a house.

According to a 2017 Goldman Sachs report, Millennial Renters …

- Search online for a rental (90%).

- Cannot afford to buy (78%).

- Prefer apartment living lifestyle (56%).

- Own pets (76%).

- Carry heavy student loan debt (71%).

According to a 2016 Freddie Mac report, 55+ Renters…

- Identify top attractions as…

– affordability (60%)

– amenities (40%)

– walkability (43%)

- Prefer relocating in…

– same neighborhood (23%)

– same city (31%)

– different city (18%)

– out of state (24%)

– close to family (60%)